Achieving lasting financial growth depends on a resilient, diversified investment portfolio. By thoughtfully allocating your assets and embracing a broad range of investment strategies, you can navigate market fluctuations, minimize risks, and enhance returns. A well-diversified portfolio spreads assets across different asset classes, regions, and sectors, providing a strong foundation for your wealth to endure challenging market conditions.

Diversification protects your portfolio from significant losses and enhances your access to new growth opportunities. As the financial landscape evolves, it allows for adaptation and the pursuit of financial goals. A diverse portfolio helps mitigate volatility and ensures steady performance, safeguarding against the negative impact of a single investment’s downturn, which is crucial for all investors.

It’s important to remember that expanding your portfolio according to distinct financial life stages is also vital for planning for retirement. Strategic diversification ensures that you have the right balance of stability, liquidity, and growth, enabling your investments to support your retirement needs without exposing you to unnecessary risks.

Understanding Diversification

Diversification is the cornerstone of sound investment management. It means spreading your investments among a mix of different asset types, geographic markets, and sectors to reduce your exposure to any single risk. Instead of relying on the performance of one stock or asset class, a diversified portfolio balances winners and losers, resulting in a more stable growth trajectory. By allocating capital across a variety of uncorrelated investments, you decrease the overall risk without necessarily sacrificing potential returns. This essential strategy helps guard your wealth during market downturns, political strife, and sector-specific setbacks. According to Investopedia, effective diversification is one of the most reliable methods for preserving and building wealth over the long term.

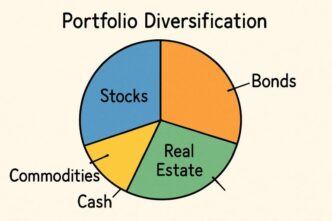

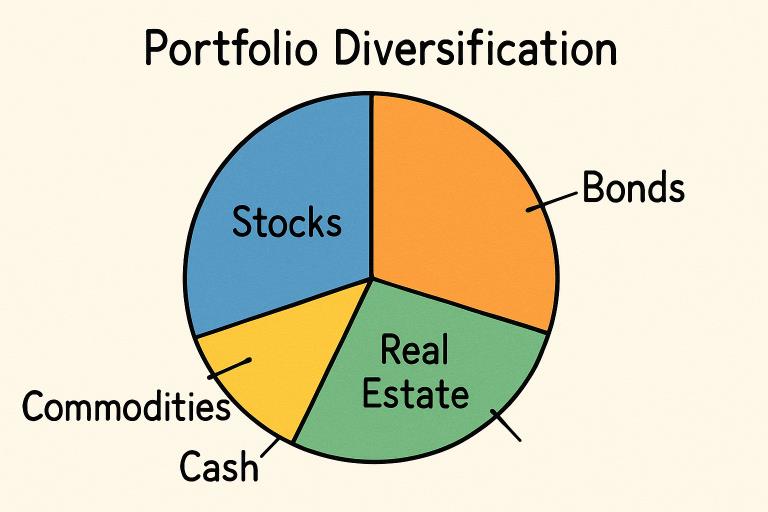

Asset Class Diversification

Allocating assets among different classes of equities, fixed income, real estate, commodities, and cash enhances your portfolio’s resilience. Stocks can offer high returns during economic booms, while bonds provide security during market downturns. Real estate acts as a hedge against inflation and often brings stable cash flow. Commodities like gold and oil diversify further by moving independently of stocks and bonds, particularly during periods of inflation or geopolitical turbulence. Maintaining an appropriate balance among these asset classes is vital for achieving steady returns while managing risk exposure. For example, during economic recessions, bonds and cash tend to outperform equities, helping cushion losses and maintain portfolio value.

Geographic Diversification

Investors who focus only on their home market risk missing out on growth and innovation in other countries. Geographic diversification dilutes the impact of local economic slowdowns, political unrest, or regulatory changes. By holding investments in developed markets in Europe or East Asia, as well as emerging economies in Latin America, India, or Southeast Asia, you tap into new consumer bases and trends. This strategy not only manages risk but can also enhance returns, as different regions rise and fall at different times. The benefits are supported by multiple studies that track the performance trends of global investments.

Sector and Industry Diversification

Even if your portfolio holds a wide variety of stocks, concentrating on a single sector (such as technology) increases risk. A diversified sector approach involves investing across industries such as healthcare, financial services, energy, and consumer goods. For example, while technology may drive growth during bull markets, utilities and consumer staples can provide stability in downturns. This reduces vulnerability to events that disproportionately impact specific industries, allowing your portfolio to maintain balance and weather sector-specific headwinds. Diversifying across sectors also enables participation in more growth stories and innovations, offering comprehensive protection and potential for performance.

Time Horizon Diversification

Different financial goals require different time frames and risk tolerance. Short-term needs, such as an upcoming home purchase, are best funded with low-risk, liquid investments, such as cash or short-term bonds. Medium-term goals can handle moderate volatility, benefiting from a balanced allocation of stocks and bonds. Long-term objectives, such as building a retirement nest egg, allow for greater risk and reward through stocks and alternative assets. Diversifying by time horizon ensures you’re not forced to sell volatile assets during downturns and that your money is ready when you need it most. This approach especially helps retirees prevent large, early losses that could compromise their lifestyle throughout retirement.

Alternative Investments

Beyond stocks and bonds, alternative investments offer unique sources of return and risk protection. Commodities like gold, silver, and energy resources serve as inflation hedges and tend to perform independently of traditional markets. Private equity, venture capital, and infrastructure projects provide access to cutting-edge innovation and stable, long-term cash flows. Private assets often behave differently from public markets, contributing to overall portfolio diversification and return potential. Allocating a reasonable portion to alternatives allows you to capture unique upside potential while reducing correlation with broader equity and bond markets. As global economies evolve, alternatives are increasingly important in sophisticated portfolios.

Regular Portfolio Rebalancing

Over time, shifts in market prices can cause your portfolio to drift away from its intended allocation, leading to unintended risk exposure. Regular rebalancing involves reviewing and restoring your asset mix to maintain alignment with your goals and risk tolerance. For example, if equities outperform their target allocation, selling some stocks and buying bonds can bring your portfolio back into balance. This disciplined strategy keeps risk in check and may enhance long-term returns by ensuring you’re always buying low and selling high. Automated rebalancing tools and annual portfolio reviews are effective ways to implement this critical step.

Conclusion

Diversification is the bedrock of smart investing and is essential for building a resilient portfolio that withstands volatility and fosters growth. By spreading investments across asset classes, geographies, sectors, time horizons, and alternative investments, you minimize potential pitfalls without compromising potential gains. Regular rebalancing ensures your plan stays relevant to your goals and adapts to market changes. With these pillars in your investment approach, you’ll be better positioned to achieve your long-term financial milestones and enjoy peace of mind, no matter what the markets bring.