A well-prepared tax return is more than a group of forms and numbers. It is a measure of the quality of work you are going to deliver and how much your clients trust you. Many tax professionals focus heavily on accuracy, which is vital, but the final presentation can be very crucial, too.

The way in which you present the documents to the clients leaves a great first impression that may determine their trust in your service. Whenever the documents are organized correctly and kept in a clean, neat, and professional-appealing folder, the clients get the first impression that their information has been handled with care. This minor action demonstrates to them that you value their personal and financial information.

It also simplifies reviews, makes them more transparent, and less stressful for them. Meanwhile, folders assist your office in being more organized and minimize unnecessary errors in the busy tax season.

Let us now explore how tax presentation folders can be used to build trust and establish a smoother working environment in your tax office.

1. Signal Of Professionalism

Whenever you submit tax returns in tax presentation folders, you are sending a powerful message regarding your professional standards. Clients immediately notice when documents are presented neatly, consistently, and with care.

Rather than distributing loose papers or mismatched packets, they are given a complete, organized package, which shows your desire to deliver high-quality service.

This simple act demonstrates to clients that their information is valuable and that you are committed to handling their documents responsibly. Therefore, they inherently gain trust in your services and in your competence to handle delicate financial issues.

2. Enhance First Impressions And Strengthen Client Confidence

First impressions carry a lot of weight when considering the reliability of the client. The clean, well-designed folder creates a positive impression even before they start to look at the figures or sign documents.

This experience helps them to have trust in the information inside since the presentation is consistent and accurate. Clients appreciate when their tax preparer portrays a high level of professionalism in each detail, including the way documents are delivered.

These minor positive experiences create long-term loyalty over time. Clients will be inclined to come back, introduce new clients, and stay dependent on your services year after year.

3. Organize Documents For Clear And Easy Client Review

Tax returns usually include various forms, schedules, worksheets, notices, and supplementary documentation. Without the necessary organization, clients can find it difficult to comprehend the information or to find particular pages.

These folders provide a structured layout that takes the clients through their papers step by step. Pockets ensure that papers do not fall out, and the slots keep the business cards or additional materials firmly attached.

When clients can review their information without feeling overwhelmed, they experience increased clarity and reduced stress. This enhances communication between you and your client and ensures that they are aware of the outcomes of your efforts.

4. Streamline Internal Workflow And Reduce Office Stress

Tax season can be very stressful due to a heavy workload, last-minute appointments, and documents to be handled every time. A standardized folder system helps streamline these processes.

When your team understands the right way to set up every tax package, you save time assembling documents and reduce the chance of missing an important form. This consistency also makes your working environment better organized since each return follows the same structure.

Consequently, this makes your office run smoothly, particularly during the busiest weeks of filing season. A predictable workflow reduces stress levels, prevents mistakes, and makes the workplace more efficient for all participants.

5. Builds Brand Recognition And Client Connection

Presentation folders can also be customized to reflect your brand identity. Custom colors, design elements, and contact information help reinforce your professional image.

These personalized touches signal to clients that they are working with a professional who pays attention to detail. When clients later review their documents at home, the folder serves as a reminder of the positive experience they had with your office.

This kind of subtle branding helps build familiarity, which is valuable in a field where trust and reliability play a major role in client retention.

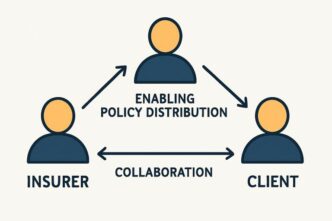

6. Compatibility With Tax Software And Professional Standards

A large number of tax professionals prepare returns in tax software. Folders intended to be used with these systems provide cover sheets, summaries, and forms to be printed and placed in folders, and not bent or folded.

Right-sized pockets, double window characteristics, and layouts in line with common tax documents all lead to a clean and well-organized presentation. This compatibility will make the experience of a client smooth and display your utilization of modern tools and processes.

It demonstrates that your office works efficiently and effectively, with current practices, helping clients feel confident that their taxes were prepared correctly.

7. Improve Document Security, Durability, And Long-term Record Keeping

Tax returns contain personal and financial information that must be protected. Durable folders safeguard these documents from spills, creases, and accidental damage.

Clients appreciate knowing that their paperwork is secure and easy to file away for future reference. Sturdy materials and protective coatings help the folder remain intact even after years in storage.

Additionally, when clients need to revisit past returns, they can quickly find what they need because everything is kept together. This level of care reinforces your commitment to security and builds trust in your ability to manage their sensitive financial details responsibly.

Conclusion

In the tax preparation profession, trust and efficiency are essential, and tax presentation folders support both in meaningful ways. They raise the level of your professional image, improve the experience of your clients, and make your team work more smoothly during the busiest times of the year.

By presenting documents in an organized, secure, and visually consistent manner, you show clients that their financial information is handled with respect and attention. Such a care level enhances confidence, fosters long-term loyalty, and builds your reputation.

Ultimately, the high-quality of tax presentation folders is a minor adjustment that makes a significant impact on client trust and operational efficiency, which are two cornerstones to success over the long term in the tax and accounting business.