While looking for a mining business, most first-time investors focus on the cost structure. They only consider whether the mine delivers high profits on small investments. And rightly so, because high-cost mines often don’t perform well in the long run.

But that’s not the only thing to focus on. You also need to choose the right type of mine, evaluate the mineral resources, check the seller’s rights and tenure, and so much more. Here’s how you can see whether the mine for sale is the right investment for you.

Identify the Type of Mine

Mines are of diverse categories with unique costs, risks, and timelines. Not every type of mine will suit your financial goals or risk tolerance.

For instance, Greenfield mining projects have the least upfront cost. These sites have not been fully explored, meaning they carry significant potential but also higher uncertainty. Discovery and production may take a long time. You may not find a lot of expensive material.

Brownfield mining projects have been previously explored, and minerals have been extracted. The proven prior extraction makes it low risk and reduces the timeline for production. However, it’s expensive, and you have to clean up past pollution before beginning.

If you don’t mind splurging on a mining business and can even bid for it, look for active/operating mines. With an established infrastructure and promising reserves, they offer immediate cash flow.

However, if you’re having a hard time spotting the available mines for sale in Australia, don’t rely on word of mouth alone. Check out popular online marketplaces where you can buy mining projects. They will have all available projects listed in one place, sorted by price and region.

Get to Know the Seller’s Legal Rights and Tenure

Find out what permits the seller currently holds. Look at their checking processing permits, mining leases, water licenses, exploration licenses, and environmental approvals.

Next, focus on the tenure. The tenure tells whether you can commercially develop a project and take the pending steps before production begins. This can vary among different Australian states and territories.

Know the exact status regarding rights and tenure to eliminate long-term uncertainties.

Assess the Mineral Resources

The value of a mine highly relies on the quality of mineral deposits, the mine size, and the mineral viability. So, ask the owner for JORC reports: the internationally recognised standard for mineral resource reporting. Check the measured, indicated, and inferred resources along with proven and probable reserves in the document. A high value in these is more profitable.

Check ore grade reports and only go for one with higher-grade deposits. These need minimal processing and have greater output. You can also compare it to market averages to make the right call.

You can also check the geological surveys mentioning the ore body depth, mineralisation continuity, drilling data, and any potential fault zones. If the geological profile is strong, you’ll face fewer challenges and expenses in the long run.

Study Accessibility and Infrastructure

Long-term and successful mining operations depend a lot on accessibility. Confirm whether the mining land has access to roads, railways, ports, power, and water.

Labourers must be able to access the location easily. Otherwise, there must be economical and safe accommodation for them nearby.

On-site infrastructure is the next important area, especially for operating and brownfield mines. Ensure it has an appropriate number of processing plants, mine shafts, and open pits. Inspect machinery condition and tailings storage facilities.

If you need to invest a lot in accessibility or infrastructure, evaluate the overall expenses. Then, compare with other options with better accessibility and infrastructure.

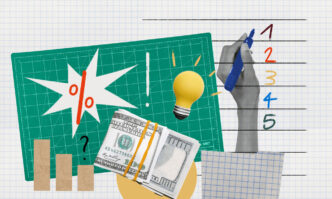

Evaluate Market Conditions

Mining has profits only if the respective ore is selling well. To ascertain that, you need to know the market price for the mineral contained in the mine. Study the past pricing trends and demand forecasts. For instance, lithium is all the rage because of the growing demand for EV batteries.

Investigate any hidden burden in the supply chain. Contact with professionals to know about the latest national and international policies that can make trade challenging. The coal trade has grown increasingly challenging because of market issues.

Ensure Thorough Compliance

Given Australia’s strict mining and environmental regulations, always review the compliance plan of the mine before investing.

Ask for safety and operational compliance, environmental approvals, rehabilitation obligations, and Native Title considerations. Partner with professionals to ensure they meet all necessary regulatory expectations. Otherwise, you’ll have to pay penalties or shut down your business later.

Conclusion

With these factors in mind, you are more likely to find a mine that can generate great long-term profits. If necessary, contact professionals in each field so they can guide you with the research, helping you find the right mine.