Retirement tends to get framed as a moment, a date circled on a calendar, a last day email with too many exclamation points. In real life, it behaves more like a long conversation you start having with yourself years before the paycheck stops. It touches money, yes, but it also reaches into housing, health, time, family roles, and the not so small question of what a good day looks like when work no longer dictates the schedule. The most grounded planning does not chase perfection. It aims for flexibility, clarity, and fewer surprises when the next chapter actually arrives.

The Shape of Income After the Paychecks End

The shift from earning a salary to living off savings and benefits is not just a math problem. It is a mindset change. Many people underestimate how long retirement can last, especially as longevity continues to improve. Income streams that felt generous on paper can feel tighter when inflation nudges prices higher year after year. Social Security timing matters, and pensions, when available, deserve careful review so their options are fully understood. Drawing down savings too quickly early on can shrink future choices, while being overly cautious can mean missing out on experiences you planned to enjoy. A steady approach that balances growth and stability helps income feel less fragile over time.

Health Care, Often the Quiet Budget Disrupter

Health care rarely announces its impact in advance. Premiums, deductibles, and coverage rules can change, sometimes with little warning. Even with Medicare, out of pocket expenses can surprise people who assumed coverage would be nearly complete. Prescription needs, routine visits, and the possibility of specialized care all add up, and the cost of medications can rise faster than many other household expenses. Planning ahead includes understanding coverage options and building room in the budget for variability. Health care planning is less about predicting every bill and more about avoiding a situation where one unexpected year derails everything else.

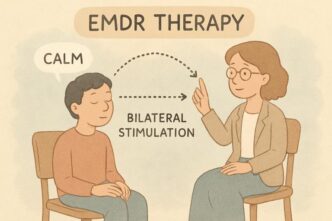

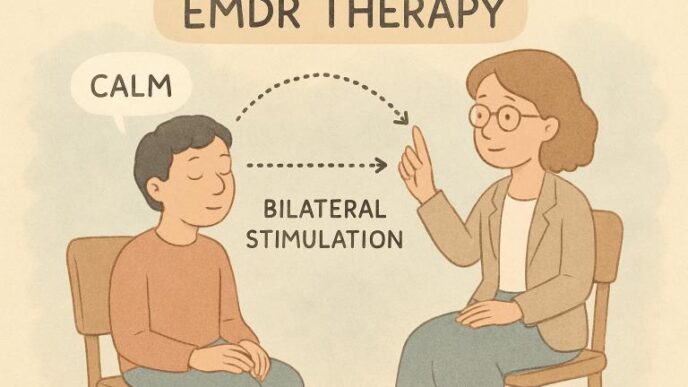

Guidance, Advice, And Knowing When Help Is Worth It

Retirement decisions often stack on top of each other. When to claim benefits affects taxes. Taxes affect withdrawals. Withdrawals affect long term sustainability. It can feel overwhelming to connect all those dots alone. Some people benefit from working with professionals who focus on later life planning and understand the regional and personal factors that shape choices. For instance, the licensed Medicare advisors at Senior Advisors in Scottsdale Arizona are known for their 100% free consultations. The value is not only in the answers but in the confidence that comes from knowing the questions were the right ones to ask. Good guidance does not replace personal judgment. It supports it.

Housing Decisions That Follow Lifestyle, Not Just Equity

A home is often the largest asset people carry into retirement, and also the most emotional. Downsizing can free up cash and reduce upkeep, but it can also mean leaving behind a community or a familiar rhythm. Staying put offers continuity but may require planning for accessibility and maintenance costs over time. Location matters more once daily commutes disappear. Proximity to family, health care, and social connections often outweighs square footage. The best housing choice aligns with how someone actually wants to live, not just what looks efficient on a spreadsheet.

Time, Purpose, And The Risk of Too Much Freedom

One of the most overlooked retirement considerations is time itself. The absence of structure can feel liberating at first and disorienting later. Many retirees find satisfaction through part time work, volunteering, or creative projects that offer purpose without pressure. Others lean into travel, caregiving, or community involvement. There is no single right formula, but there is value in thinking about days and weeks, not just years. Purpose does not have to be grand. It just needs to feel meaningful enough to get out of bed with interest rather than obligation.

Family, Legacy, And Conversations Worth Having Early

Retirement planning often intersects with family expectations, sometimes in ways people avoid discussing. Adult children may assume help with grandchildren or elder care. Parents may want clarity about inheritance or support later in life. These conversations are easier when they happen early and honestly, before a crisis forces rushed decisions. Legacy planning is not only about money. It includes values, memories, and the example set for younger generations about preparing thoughtfully for the future.

Planning That Leaves Room To Live

The most resilient retirement plans share a common trait. They leave room to live. They account for change, allow for adjustment, and avoid locking everything into a single rigid path. Retirement considerations work best when they respect both numbers and nuance. The goal is not to control every variable but to reduce stress and increase choice. When planning feels supportive rather than restrictive, retirement stops being a finish line and starts looking like what it really is, a long stretch of life still rich with possibility.