Introduction to Managing General Agents

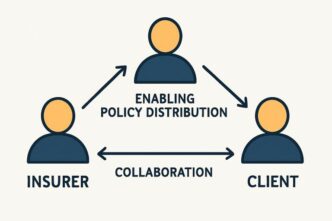

In the evolving insurance landscape, Managing General Agents (MGAs) have carved out an essential niche. MGAs act as specialized intermediaries between insurers and agents or brokers, often possessing broad authority to underwrite policies, set pricing, and even manage claims on behalf of insurers. This unique positioning empowers them to develop tailored products and tap into specialized or underserved market segments—a flexibility seldom matched by traditional carriers. For a deeper understanding of what sets an MGA insurance company apart in the industry, exploring its operational structure can provide valuable context.

By bridging the gap between insurers and their target markets, MGAs ensure a more efficient and dynamic distribution of insurance products. Their expertise and agility enable them to swiftly address specific risks or coverage demands that would otherwise be overlooked within a one-size-fits-all model. MGAs frequently operate in the excess and surplus (E&S) lines, catering to sectors that are often too volatile or complex for conventional channels. This adaptability not only improves market reach for insurers but also fosters greater innovation and competition across the industry.

Significant Growth in the MGA Market

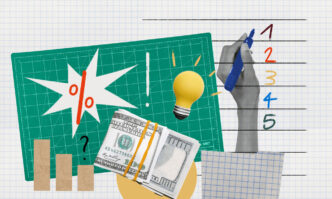

The rise of MGAs has been striking in recent years. According to recent industry assessments, U.S. MGAs wrote over $114 billion in direct premiums during 2024—a remarkable 16% increase from the prior year. This consistent surge significantly outpaces the overall growth rate of the property and casualty insurance market, which grew approximately 10% during the same period. Several factors underpin this expansion, including the migration of seasoned underwriting talent away from traditional carriers, the broadening adoption of digital tools and artificial intelligence, and persistent inflows into the E&S insurance market. This vibrant growth cements MGAs as essential players, capable of filling gaps where traditional insurers may lack specific expertise or flexible strategies.

Heightened market volatility and evolving risk exposures—such as those posed by climate change, emerging technologies, and shifting legal environments—have further fed the growth of MGAs. Their ability to adapt product offerings, leverage niche knowledge, and make rapid operational decisions puts them at the forefront of insurance innovation. Insurers increasingly turn to MGAs to diversify their portfolios, access hard-to-reach markets, and respond with agility to new challenges.

Technological Advancements Enhancing MGA Operations

Modern MGAs are leveraging technology in unprecedented ways, setting new benchmarks in efficiency, accuracy, and client experience. Artificial intelligence and automation have enabled MGAs to streamline underwriting processes and enhance claims handling, allowing for more precise pricing and improved risk assessment. Machine learning models leverage extensive datasets to refine underwriting guidelines and predict risk patterns, thereby reducing the time and cost associated with traditional manual reviews.

Notably, digital platforms facilitate real-time collaboration among carriers, agents, and clients, offering seamless onboarding and policy servicing. Self-service portals, automated document generation, and integrated customer communication tools have all contributed to a smoother and more transparent client experience. As regulatory requirements and customer expectations evolve, technology has become a vital lever for MGAs to maintain compliance while continuing to deliver specialized value.

Opportunities and Risks Associated with MGAs

MGAs represent a win-win proposition for insurers and reinsurers, offering access to niche markets and specialized expertise that would be difficult and costly to develop internally. Their market agility, specialized products, and deep relationships with specific industry sectors give carriers a competitive advantage. However, this delegation of authority is not without intricacies or hazards. Insurers must establish robust oversight and governance frameworks to ensure MGAs adhere to underwriting guidelines, regulatory standards, and prudent risk appetites. Failure to do so can expose carriers to adverse selection and reputational risks.

The breakneck expansion of the MGA segment also necessitates ongoing vigilance. Rapid premium growth carries the potential for undisciplined underwriting, decreased loss ratio control, and operational misalignment. As MGAs assume increasing levels of control over product design, pricing, and claims, insurers must consistently evaluate performance, monitor risk exposure, and adjust contractual arrangements accordingly.

Final Thoughts

Managing General Agents have evolved into indispensable contributors to the modern insurance marketplace, combining technical expertise, flexible product delivery, and superior market access. As direct premiums written by MGAs continue to increase, driven by technology and the broadening of market needs, they present a unique set of strengths and risks to insurers, reinsurers, and clients alike. Industry stakeholders must thoughtfully balance the substantial opportunities provided by MGAs with comprehensive oversight and risk management practices. In doing so, MGAs will remain trusted and innovative partners within the insurance value chain, advancing the industry forward.