Let’s be honest: when we think about banks, credit unions, or investment firms, we don’t just think about vaults and safety deposit boxes anymore. We think about apps on our phones, instant transfers, and digital wallets. This incredible convenience comes with a colossal target on its back. For any organization that handles money, security isn’t just a feature; it’s the very foundation of its existence. Relying on advanced security isn’t a choice; it’s a matter of survival. It’s about protecting not just funds, but the fragile, invaluable commodity of trust.

The Stakes Have Never Been Higher

Imagine a small, local bank. Fifty years ago, its biggest physical threat might have been a bank robber with a note. Today, that same bank faces a global onslaught of threats 24/7 from hackers who could be thousands of miles away. The potential fallout of a breach is catastrophic, extending far beyond stolen cash.

- Financial Losses: Direct theft of funds, crippling ransomware payments, and massive regulatory fines.

- Erosion of Trust: If customers don’t feel their money is safe, they will leave. Rebuilding a tarnished reputation is a long, painful climb.

- Operational Collapse: A severe attack can freeze transactions, halt trading, and shut down customer access, effectively paralyzing the business.

- Legal Repercussions: Organizations are legally bound to protect client data. Failures can lead to lawsuits and sanctions.

In this environment, a simple firewall and a strong password policy are the equivalent of a padlock on a screen door. The adversaries are too sophisticated, and the stakes are too high.

The Modern Arsenal: More Than Just Antivirus

So, what does advanced security actually look like in practice? It’s a constantly evolving strategy that protects from the outside in and the inside out.

| Pillar | What is it? | Why does it matter? |

| AI and behavioral analytics | Systems that learn normal user and network behavior to flag anomalies in real-time. | Can detect a fraudulent transaction initiated by a compromised account before it’s completed, stopping theft in its tracks. |

| End-to-end encryption | Scrambling data into unreadable code from the moment it’s sent until it’s decrypted by the intended recipient. | Ensures that even if data is intercepted, it’s useless to the attacker. This protects every payment and message. |

| Zero-trust architecture | A “never trust, always verify” model. No user or device inside or outside the network is trusted by default. | Dramatically reduces the damage from stolen credentials, as access is strictly limited and continuously checked. |

| Biometric authentication | Using fingerprints, facial recognition, or voice patterns as a key part of logging in. | Makes account takeover exponentially harder, as it requires something you are, not just something you know (like a password). |

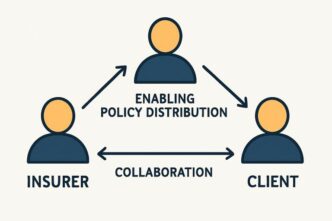

We can’t embrace new digital tools without also making sure they’re locked down tight. The threats are always changing, and so do we have to. The holistic approach of cybersecurity in banking for financial institutions encapsulates this shift from reactive defense to proactive, intelligent protection. It’s a recognition that the perimeter is everywhere; in a customer’s smartphone, in a cloud server, in an employee’s laptop. This philosophy demands integration, where technology, processes, and human vigilance work in concert.

The Human Element: The Strongest Link and the Weakest

Technology is brilliant, but it’s not infallible. The human element remains critical. This is why advanced security programs invest heavily in two areas focused on people:

- Continuous Employee Training: Staff at all levels are trained to recognize phishing attempts, social engineering ploys, and internal security protocols. They are the first line of defense.

- Dedicated Threat Intelligence Teams: These are the digital watchtowers. They don’t just respond to incidents; they scour the dark web, study emerging hacker tactics, and proactively shore up defenses before an attack wave hits.

A bank can have the most expensive encryption in the world, but one employee clicking a malicious link can open a backdoor. Conversely, a vigilant employee who reports a suspicious email can prevent a multi-million dollar disaster. Culture is everything.

The Bottom Line: It’s About Confidence

Ultimately, money-related organizations rely on advanced security for one overarching reason: to maintain confidence. When you log into your banking app, you have confidence that your balance is correct and private. When a business sends a six-figure wire transfer, it has confidence that the money will reach the right account. When investors buy stock, they have confidence that the market’s integrity is protected.

| Immediate impact | Secondary consequences | Long-term damage |

| Direct financial theft | Regulatory investigations and fines | Permanent loss of customers |

| Service disruption | Cost of forensic analysis and repair | Severe brand reputation harm |

| Data compromise | Customer notification and credit monitoring costs | Erosion of investor confidence and stock value |

This confidence is the lifeblood of the entire financial system. Without it, the gears of the global economy grind to a halt. Advanced security is the heavy, often invisible, armor that protects that trust. It’s a relentless, costly, and complex undertaking, but for any organization that handles what matters most to people, it is the most important investment they can make. It’s no longer just about protecting money; it’s about safeguarding our digital way of life.