Key Takeaways

- Adopting a comprehensive financial strategy enhances nonprofit sustainability by enabling proactive management and long-term planning.

- Diversifying revenue streams reduces dependency on single funding sources, protecting organizations against unforeseen financial shocks.

- Leveraging technology enhances financial efficiency and transparency, enabling better decision-making and fostering stakeholder confidence.

Effective financial management is the bedrock of a thriving nonprofit, underpinning every program, service, and outcome an organization seeks to achieve. To sustain their missions and serve community needs effectively, nonprofits must adopt a holistic approach—one that blends strategic planning, funding diversity, and technological solutions into an integrated financial system designed for stability and growth. This encompasses managing budgets with foresight, building robust reporting systems, and understanding external factors that shape financial conditions. Comprehensive financial management enhances organizational resilience against the inevitable fluctuations in funding, ensuring that every dollar advances the mission as efficiently as possible. For organizations seeking specialized insights and tools in nonprofit financial management, experts at https://www.portebrown.com/industries/not-for-profit provide tailored industry guidance and resources.

Nonprofits must move beyond short-term solutions and singular revenue streams to embrace holistic financial management. This involves anticipating economic changes, engaging in detailed scenario planning, and pursuing long-term goals. Integrating innovative systems enhances resilience and supports mission fulfillment, fostering stakeholder trust through transparency. Adaptability is crucial in the dynamic nonprofit sector, allowing organizations to capitalize on emerging opportunities and maintain impact. By investing in infrastructure and staff capacity, nonprofits can effectively navigate volatility, ensure sustainability, and improve both financial health and mission-driven outcomes.

Strategic Financial Planning

Building a sustainable financial future starts with strategic planning that is grounded in an organization’s mission and vision. Nonprofits must closely align their budgets, resource allocations, and funding strategies with well-articulated, long-term organizational goals. This not only involves adopting a disciplined budgeting process but also considering how every dollar spent supports core activities. The planning process should include regular scenario modeling, projecting how shifts in the economy, funding sources, or the policy landscape might affect operations, and implementing risk assessments. Frequent reforecasting enables the organization to remain nimble and responsive, adjusting strategies to mitigate emerging risks and capitalize on unexpected opportunities. Effective planning ensures financial decisions reinforce the mission, empower responsible stewardship of donor funds, and allow leadership to course-correct as needed. Consistently updated strategic plans help nonprofits navigate complexity and uncertainty, ultimately creating a more sustainable and impactful organization.

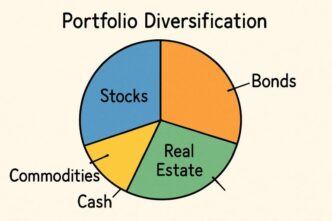

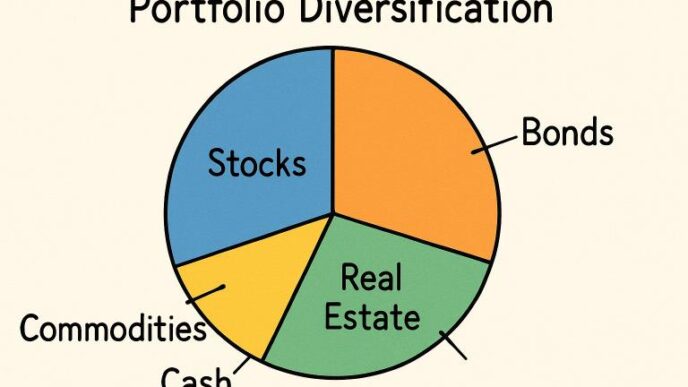

Diversifying Revenue Streams

A robust and resilient financial plan for nonprofits extends far beyond relying exclusively on government grants or a handful of major donors. True financial security is built upon diversification, which brings together various revenue streams, including program fees, earned income activities, special events, crowdfunding, foundation grants, and corporate sponsorships. For example, a health-focused nonprofit might increase income and engagement by hosting community workshops, launching a branded merchandise line, or developing fee-based consulting services. Similarly, arts organizations can explore creative ways to monetize educational outreach or collaborate with local businesses for event sponsorships. With a diversified funding portfolio, nonprofits are better equipped to weather economic downturns, policy changes, or shifts in donor priorities—each of which can profoundly affect traditional revenue sources. By nurturing multiple income streams and regularly evaluating their sustainability, organizations foster long-term stability and preserve their capacity to fulfill their missions irrespective of external changes.

Leveraging Technology

Modern financial management in the nonprofit sector increasingly depends on embracing digital tools for enhanced accuracy, efficiency, and transparency. Today’s cloud-based accounting systems provide organizations with real-time access to financial data from any location, empowering leadership teams to react more swiftly and make better-informed decisions. Automated donation platforms simplify the process of collecting and tracking gifts, while integrated reporting solutions minimize administrative burden, streamline compliance requirements, and significantly reduce the potential for human error. Furthermore, advanced data analytics tools help organizations identify trends, forecast financial health, and allocate resources more effectively. This digital transformation not only enhances internal operations and accountability but also improves donor confidence by making financial information more readily accessible and reliable, leading to stronger relationships and ongoing support.

Implementing Zero-Based Budgeting

Zero-based budgeting (ZBB) is a dynamic approach that requires organizations to justify every line item in their budget for each new cycle, rather than simply carrying over the previous year’s figures. This method prompts leaders to critically evaluate the effectiveness of ongoing programs and administrative expenses, foregrounding impact and relevance over tradition or habit. ZBB fosters a culture in which financial resources are allocated based on current priorities and evidence of success, rather than inertia. By encouraging teams to think deliberately about each expenditure, nonprofits can avoid the common pitfall of funding outdated programs or inefficient activities. Ultimately, zero-based budgeting ensures fiscal discipline and that each dollar is invested to maximize mission outcomes.

Enhancing Internal Controls

Protecting financial integrity is essential for every nonprofit, as it helps safeguard assets, build donor trust, and prevent fraud or misuse. Achieving this requires establishing and executing robust internal controls, including clear policies for spending approvals, meticulous segregation of responsibilities among staff, and regular internal or external audits. Nonprofits should implement systems for early detection of errors or suspicious activities, and provide consistent training for staff and volunteers to ensure everyone understands their ethical and legal obligations. Transparent financial reporting, frequent reconciliations, and routine process reviews create a strong culture of compliance and accountability—a critical factor for maintaining public trust and organizational reputation.

Building Operating Reserves

Without sufficient reserves, even the most well-managed nonprofits may struggle to survive periods of instability, such as funding shortfalls, loss of a major donor, or unforeseen crises like natural disasters or public health emergencies. Best practice is to maintain operating reserves equivalent to at least three to six months of typical operating expenses, though some organizations set aside even more if their risk profile suggests it’s necessary. Strong reserves provide a financial safety net, enabling nonprofits to continue delivering essential services and experimenting with new approaches during challenging times. Building and monitoring reserve funds over time provides stability and reassurance for stakeholders, reducing anxiety during lean periods and providing a buffer to support innovation and mission growth.

Forming Strategic Partnerships

Collaboration is a force multiplier for nonprofits, allowing for the pooling of resources, talent, expertise, and access to broader networks. By forming strategic alliances with like-minded partners—including other nonprofits, for-profit businesses, government agencies, or educational institutions—organizations can pursue shared use of facilities, co-branded projects, joint advocacy campaigns, and new funding opportunities. These partnerships can also spark innovation, give rise to new program models, and reduce overhead costs by sharing back-office infrastructure. Aligning with partners who share similar missions and values ensures clear communication and mutual benefits. Thoughtfully structured partnerships create new avenues for sustaining impact and scaling proven programs for communities in need.

Conclusion

A holistic approach to financial management empowers nonprofits to navigate uncertainties and fulfill their missions with confidence. By prioritizing strategic financial planning, diversifying revenue streams, leveraging digital innovation, and implementing strong internal controls, organizations are better positioned to ensure both regulatory compliance and meaningful impact. The systems and partnerships that nonprofits build and refine today will not only help them survive current challenges but also lay the groundwork for mission-driven success and community service for years to come.